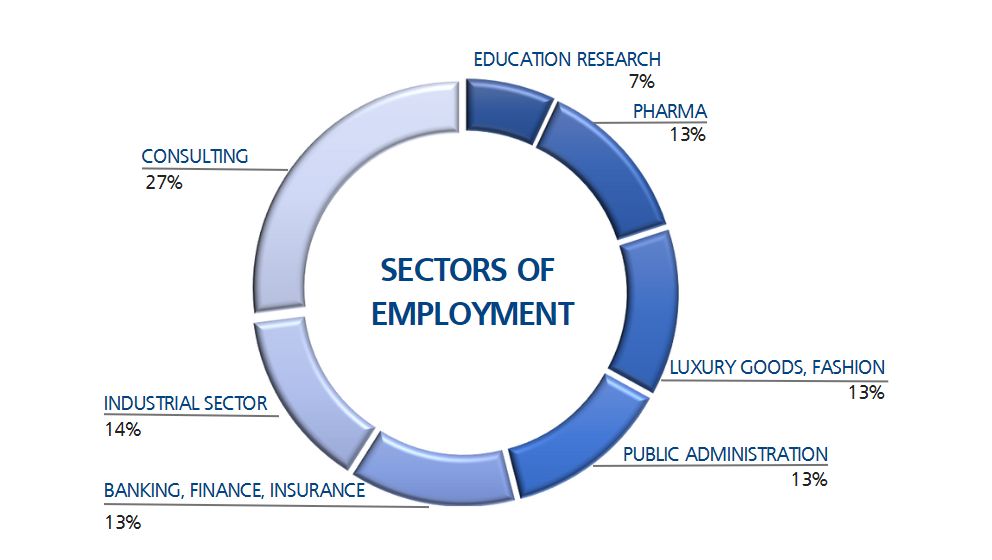

The interdisciplinary approach offered by the MEPIN has enabled its graduates to work quickly and successfully in multinational companies, banks and finance companies, local authorities, non-governmental organisations, education and research institutes. Graduates of this Master's programme possess both multidisciplinary skills and specific knowledge, particularly in economics and political science, which enable them to work in all areas where the public and private sectors cooperate.

Here are some of the more than 100 employers of MEPIN Alumni (source: USI Career Service)

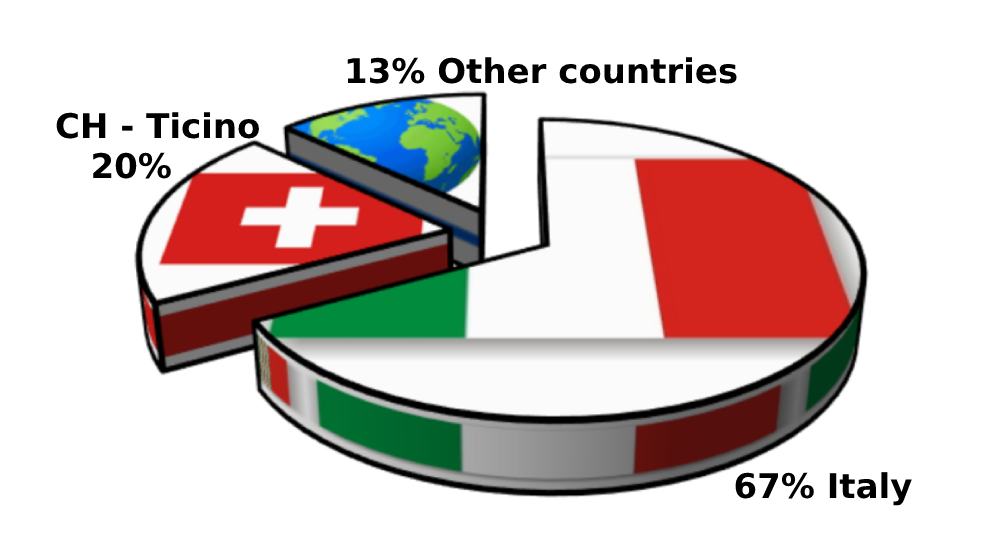

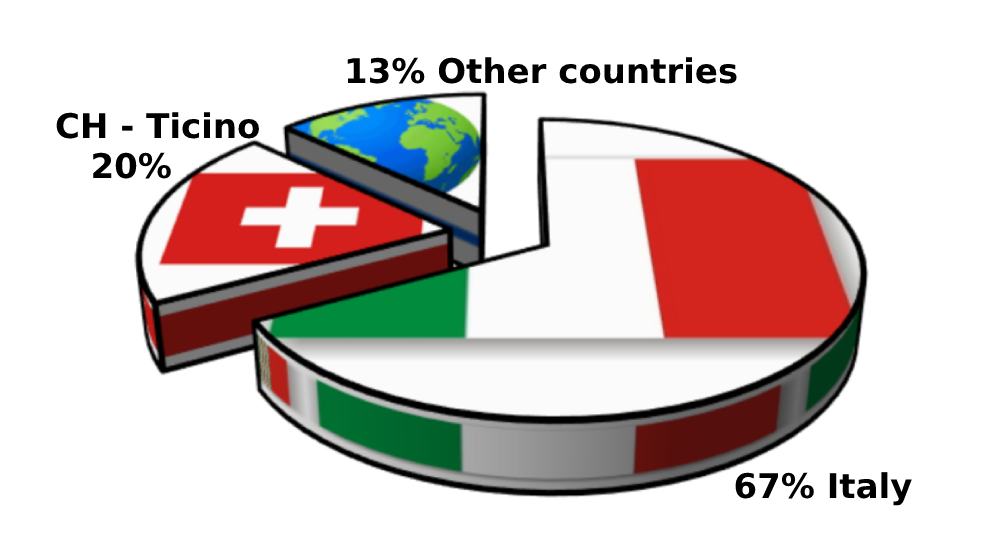

According to the 2022 USI Master Survey (Alumni 2021),

Here below a quick glimpse at the main MEPIN key facts.

Here some job profiles of MEPIN graduates:

Economic Consultant (Economist)

Economists are economic and financial experts who study market activity. Their primary responsibilities include collecting and analyzing financial and socio-economic data, advising businesses and governments on economic decisions and developing models for economic forecasting. Economists conduct research, prepare reports or make plans to address economic problems related to both the production and distribution of goods and services and monetary and fiscal policy.

Public Affairs Consultant

Public affairs consultants are responsible for providing their clients with valuable information on the political environment and advice on public affairs and government policy.

Both public and private sector organizations employ public affairs consultants. They can also be NGOs (non-governmental organizations), think tanks and government administrations from other countries, as well as international bodies such as the United Nations and the European Commission.

Public affairs consultants monitor and track information from public and private sources regarding governmental, industrial, economic, social and other issues, consolidating it into relationships to keep their customers informed and offering advice and guidance on potential lines of action.

Political Risk Analyst (Country Risk Analyst or Geopolitical Risk)

Political risk analysts examine issues such as economic conditions, crime levels, the threat of conflict, the stability and governance of law enforcement authorities, trade and regulation or humanitarian and human rights issues. They work in or with a range of private sector companies to support commercial and investment decisions, or on behalf of governments and non-governmental organizations (NGOs) to assist decision making and national and international strategy.

Academic Researcher

Academic researchers carry out high-level research that generates new knowledge and advances knowledge in a specific area. Academic researchers apply their skills and abilities accumulated during postgraduate or postdoctoral education, in the publication of research articles in high quality specialized journals, in the preparation of reports, books or book chapters on specific topics. In addition, academic researchers are often involved in teaching activities, including supervising students and presenting their work at seminars and conferences.

Account Manager / Specialist

Account Managers identify new business opportunities among existing customers and are responsible for developing solid customer relationships, liaising with executives and stakeholders, and preparing sales reports. In this role, account managers work with internal inter-functional teams (including the Customer Service and Product Development departments) to improve the entire customer experience.

Compliance Officer / Specialist

Bank compliance officers / specialists are responsible for conducting audits and inspections to ensure that a bank adheres to internal and external laws. Their work involves monitoring and analyzing risk areas in a bank's operations to ensure compliance with cantonal or national laws.